48+ how many extra payments to cut mortgage in half

Be sure to have a written contract with the border so each party knows what is expected. The result is a home that is free and clear much faster and tremendous savings that can rarely be beat.

Mortgage Payoff Calculator Accelerated Mortgage Payment Calculator With Extra Payments

Additionally youll save by paying thousands of dollars in fees.

. Web If you pay 100 extra each month towards principal you can cut your loan term by more than 45 years and reduce the interest paid by more than 26500. Web With 52 weeks in a year this approach results in 26 half payments. Web Extra Mortgage Payments Calculator.

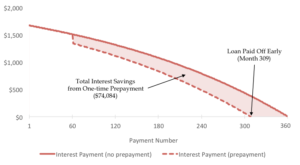

Web That means 26 half-payments or 13 full payments which is one extra payment per year. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. Those additional payments toward your mortgage can save you major money in.

Be sure to check with your bank and make sure they dont charge any fees for switching to a biweekly payment schedule. But this strategy is somewhat rare these days. Pay a little more each month One surefire way to pay off your loan sooner and pay less interest is to increase.

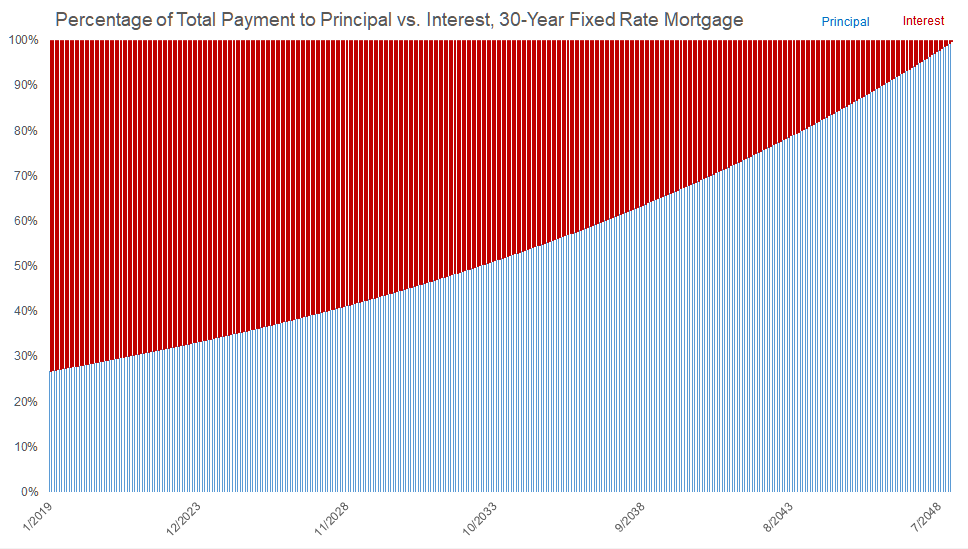

Web Borrowers who want to cut the life of their mortgage in half can do it in many ways. Web You can just divide your mortgage payment by 12 and add 112th the amount to your payment each month. For example the four savings plans shown below would all pay off my 100000 15-year 6 mortgage in 90 months.

Web You end up making the equivalent of 13 payments instead of the required 12 payments every year. What happens if I pay my mortgage principal an extra 100 monthly. Web In this scenario an extra principal payment of 100 per month can shorten your mortgage term by nearly 5 years saving over 25000 in interest payments.

Web This lets you pay half your mortgage bill every two weeks instead of once a month. We also offer three other options you can consider for other additional payment scenarios. Web If half of each of your paychecks goes to your mortgage you still have only 24 mortgage based payments leaving two extra paychecks per year that do not apply to your mortgage.

Doing so results in 26 half-payments or 13 full monthly payments each calendar year. Taking in a border and applying his monthly rent payment to the loan as a principal only payment will help reduce your mortgage by at least 10 years over the life of the loan. If you pay 200 extra a month towards principal you can cut your loan term by more than 8 years and reduce the interest paid by more than 44000.

Therefore if your regular payment is 1500 a month you would pay 1625 each month instead. Web Mortgage Calculator With Extra Payments. Unless you specify that the additional money youre paying is meant to be applied to your principal balance the lender may use it to pay down interest for the next scheduled payment.

Web Assuming you have a 200000 30-year mortgage at a 4 interest rate youd need to pay about an extra 500 a month toward your principal to drop your repayment period from 30 to about 15 years. Because of this you likely have an additional months mortgage payment without realizing it. Use the Extra Payments Calculator 1 to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan.

You might even come close to cutting them in half. At that rate by the end of the. Web A biweekly mortgage payment plan involves making half of that mortgage payment or 104750 every two weeks for a total of 26 payments each year.

Write on your payment coupon Extra Principal Payment 302 so there is no question of where you are directing the funds and keep a copy of the coupon and the check for your records. Web If you do this you will cut your mortgage payoff time in half. If you want to accelerate it even faster say cut it by 23rds if on 81 you make the payment.

Check with your bank or lender to ensure that it will accept bi-weekly payments instead of monthly. If youre able to make 200 in extra principal payments each month you could shorten your mortgage term by eight years and save over 43000 in interest. To be more precise itd shave nearly 12 and a half years off the loan term.

Enter your loan information and find out if it makes sense to add additional payments each month. Web Throwing in an extra 500 or 1000 every month wont necessarily help you pay off your mortgage more quickly. Some people also use tax refunds performance bonuses other similar streams to help create a 13th yearly payment.

Deposit one-twelfth of the monthly principal payment into a savings. They are thus alternatives to the double amortization plan with its rising extra payment. If you currently have 18 years left in your repayment term and the lender extends the term back to 30 years it could significantly reduce the size of your monthly mortgage payments.

Web By paying 26 half payments during the year and paying an extra months worth youre putting more money towards the principal balance which ends up shortening your mortgage. Web You may cut your loans term by an average of four to six years if you can scrounge together the money for one additional payment against your mortgage each year. Use a savings account.

Web Here are three solid strategies to pay off your mortgage early. Make an Extra Mortgage Payment Every Year Throw all or a portion of new-found money like a year-end bonus or inheritance at the mortgage. Web An easy way to make 13 mortgage payments every year is to divide your monthly principal and interest payment by 12 not including any property tax or insurance escrow.

Take in a boarder. The biweekly payments option is suitable for those that receive a paycheck every two weeks. Web Paying an extra 1000 per month would save a homeowner a staggering 320000 in interest and nearly cut the mortgage term in half.

Thus borrowers make the equivalent of 13 full monthly payments at years end or one extra month of payments every year.

326 By Steurbaut Issuu

Scan Magazine Issue 129 October 2019 By Scan Client Publishing Issuu

How Does Prepaying Your Mortgage Actually Work Sensible Financial Planning

Mortgage Payoff Calculator Your New Debt Free Secret Weapon March 2023 Millennial Homeowner

Mortgage Due Dates 101 Is There Really A Grace Period

Mortgage Payoff Calculator Accelerated Mortgage Payment Calculator With Extra Payments

Sterling September 2019 European P2p Lending Portfolio Update P2p Millionaire

The Best 18 Month Cd Rates Of March 2023

Mortgage Payoff Calculator Ramsey

Extra Mortgage Payment Calculator What If I Pay More

Extra Payment Calculator Is It The Right Thing To Do

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

What S The Return On Mortgage Prepayments

Mortgage Calculator With Extra Payments Payment Schedule

Google Ranking Faktoren 200 Fakten Mythen Und Begrundete Spekulationen

Extra Payment Mortgage Calculator Making Additional Home Loan Payments

Extra Mortgage Payment Calculator Calculate Mortgages With Additional Overpayments